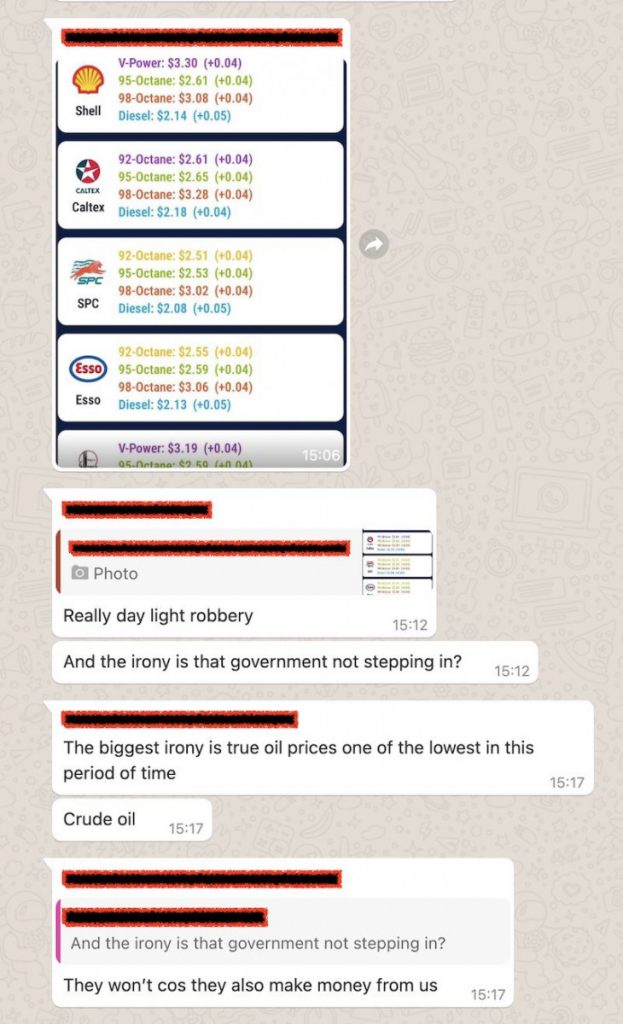

I was going through my day as usual when I received an alert on my mobile phone. It was a WhatsApp text message shared in a rather closed-knit chat group.

It appears that the petrol companies here in Singapore have raised their pump prices yet again. Prices have risen by 4 to 5 cents a liter across the board. A liter of 95-octane gas now costs S$2.61 – this translates to approximately US$8.82/gal or US$1.94/liter for the non-SG folks reading this. Yup! Gas prices in Singapore is heavily taxed.

As consumers, we hate high prices. It was natural for rants to start appearing. Some blamed the government. Some expected the government to step in to regulate prices. One even commented in curiosity that prices were climbing despite crude oil being at its lowest during this period of time.

Yeah – LOWEST!….. Or is it?

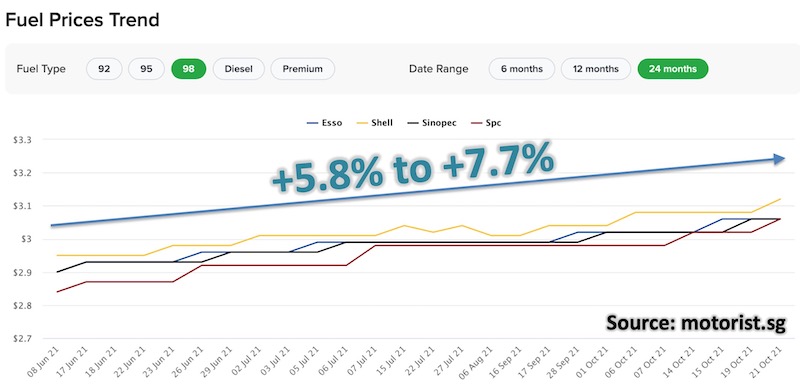

A quick hop over to motorist.sg confirmed the suspicion – that petrol prices here in Singapore have indeed been on the rise. In the last 4 months or so, pump prices in Singapore have been sneakily shifting upwards every couple of weeks.

While I would have loved to gather data for a longer term, unfortunately motorist.sg only availed data from 08Jun21 to 21Oct21 (yesterday). During this period, pump prices have risen by 6% to 8% – that’s just over a 4.5mth period! Annualised, this would translate to an eye-popping 15.5%pa to 20.5%pa rise!

But… is there any truth in crude oil prices being at its lowest during this period? Let’s find out…

Data of price of crude oil during the same period of time seem to suggest a similar upward trend. So it isn’t true that crude oil prices are at a low. In fact, during this same period, crude oil prices have climbed 18.5% – that’s approximately 3x as much compared to pump prices rise of a “mere” 6% to 8%!

Now, let’s all accept that the government is unlikely to successfully mandate the petrol companies not raise pump prices. These are for-profit companies, not charities. When oil price rise, they simply past the cost on to consumers. Question then is, as consumers, are we fully at the mercy of these heartless, scrupulous, and profit maximizing oil giants? Is there anything we could do to protect and defend ourselves from these seemingly relentless price increases?

Actually, YES! As the saying goes – If you cannot beat them, JOIN them!

BUY oil! On paper – that is.

Now, if one had invested in Crude Oil during the same period of time, you’d do well and be up by 18.5%. Thus, the 6% to 8% increase in pump price would look like a, meh….

Yes, granted that crude oil is typically traded on the futures exchange. And not many have the know-how, access, or even risk appetite to trade a futures contract. No fear – there are ETF’s (exchange traded fund) out there that tracks the price of crude oil.

Take for example the Horizons Crude Oil ETF traded on the Toronto Stock Exchange in Canada. If one had purchased the ETF in that same period of time, you’d be up by more than 16%.

“But… but… but… That’s in Toronto, Canada! And priced in CAD$ too! I don’t want to / don’t have access to the Toronto Stock Exchange. Is there something I can buy in Singapore and in SGD instead?”

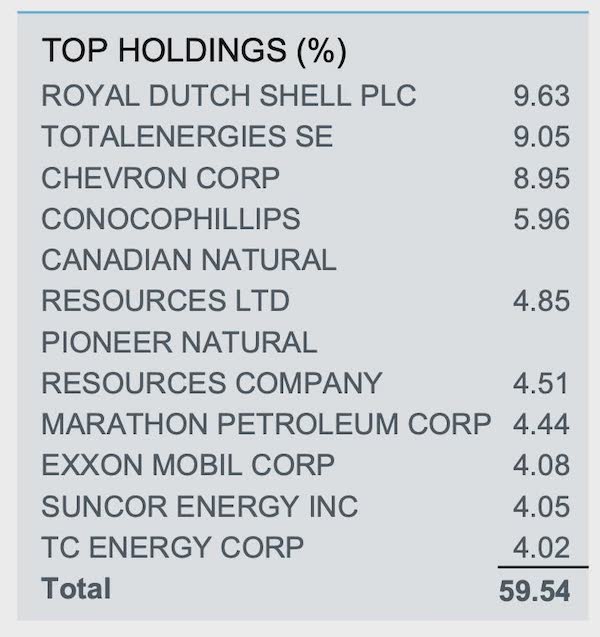

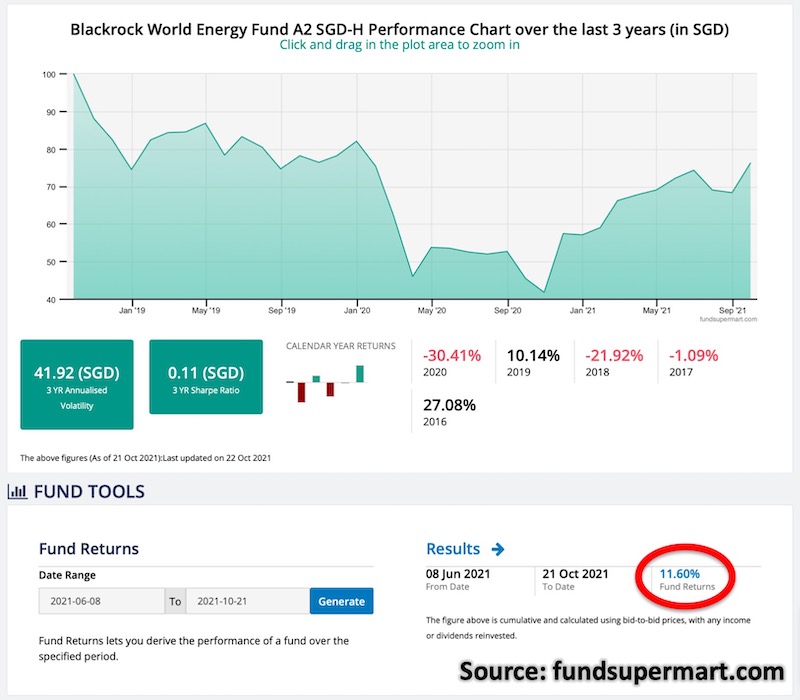

Errr…. yah. One can still participate in the energy story via the BlackRock World Energy fund. The fund invests in some of the top global energy names, and even have a SGD-hedged share class.

So, how has this fund performed in the same period so far? Not too bad actually! During between 08Jun21 to 21Oct21, the fund gained 11.6% compared to the rise in pump prices of 6% to 8% in the same period. Take that pump price!

Important Disclaimer:

This is NOT financial advise. This is NOT a recommendation to purchase any of the mentioned investments. This is purely information sharing for the purpose of discussion and financial education only.

Important Disclosure:

I do not own any of the above mentioned investments and have no intentions of owning any of the above mentioned investments within the next week. I do, however, have a significant portion of my personal portfolio with exposure to the energy sector. They are, however, mainly in the clean, green, renewables, and the low/no carbon emissions energy space – in line with the recent attitudes towards ESG investing.

I know I cannot beat them, so I decided to join them. And the next time I head to the pump, I may feel a slight pinch with the increased price. But with the price rise I’d be reminded that it’s actually really doing good to my wallet after all. =)

The reason why they don’t adjust prices much even when oil is cheaper.

We have to take a look at the land they bid for.

All the land parcel for petrol station is valid for 30 years.

Think in the 90s. Some are bid at 30 mil. Few years back. think got one at Woodland at for 130mil.

Think oil giant will consolidate all land expenses together and divided as accordingly. And the factor into petrol prices